^ That's my dilemma at the moment Hughesy. It's clear we'll never make a large profit from our smallholding. However, we will have an income of perhaps a couple of thousand a year, and yes I would love to run things at a profit if that is possible!

So, when I do my tax return, I now can't really put zero in the box that asks for income from other employment. (Even if it's not a

profit, it's still an income).

My current feeling is that I'd rather not have the hassle, BUT if I'm going to be forced into registering as a sole trader smallholder, I'm darn well going to put in all the legitimate expenses that I can, and claim them back against the income from my other paid employment. I'm also going to register for VAT so I can claim my input vat back where possible too.

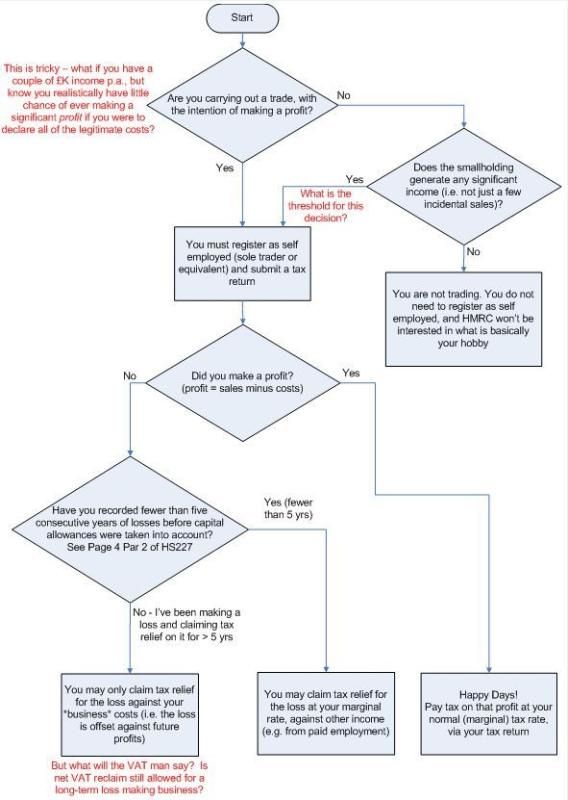

I sent this flowsheet to my accountant earlier, as she's trying to help me decide what to do. This shows

my understanding of how things work, not hers, so it may of course be wrong. If that's the case, please correct me, as I'm finding all this quite a headache at the moment!!